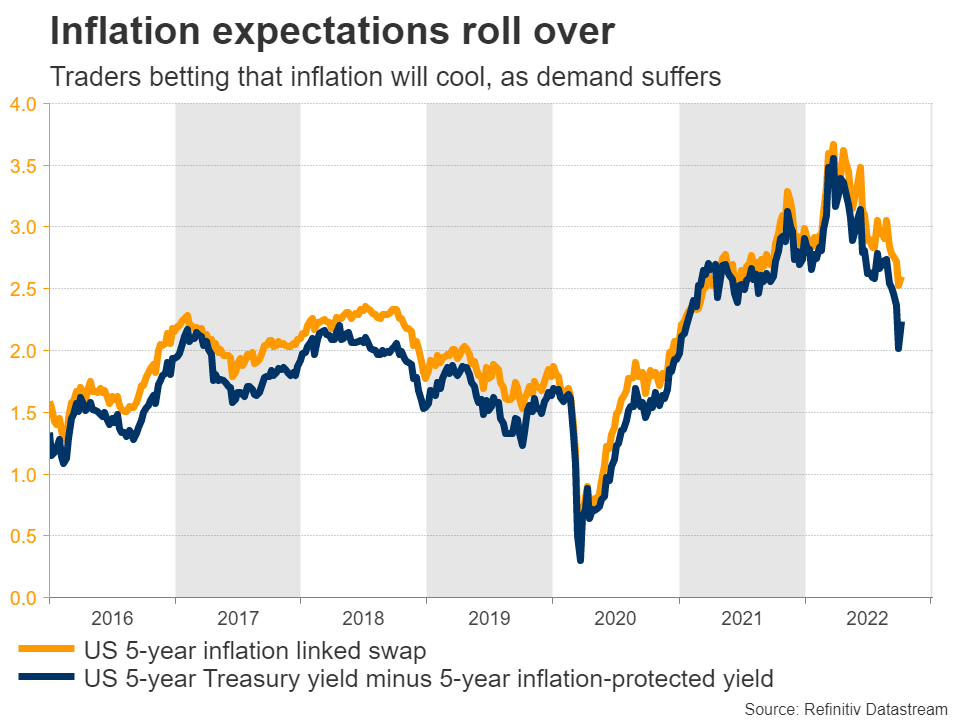

As the first quarter of 2023 comes to a close, investors are holding their breath as they await key inflation data that could have a significant impact on U.S. stocks. With the Federal Reserve’s monetary tightening path hanging in the balance, Wall Street’s main indexes have been muted as investors brace themselves for the storm that may be on the horizon.

The Waiting Game

Investors have been on edge as they wait for the release of key inflation data that could have a significant impact on the U.S. economy. With the Federal Reserve’s monetary tightening path at stake, Wall Street’s main indexes have been muted as investors await the storm that may be on the horizon.

The Nasdaq has been set for its biggest quarterly percentage gain since the end of 2020, thanks to a rotation into major technology and growth stocks from financial stocks during the banking crisis. However, signs of sticky U.S. inflation, shockwaves from the collapse of two regional U.S. banks, and trouble in some European banks have caused a repricing of interest rate expectations from the Fed.

The Federal Reserve’s Two-Day Policy Meeting

The Federal Reserve’s two-day policy meeting is always a highly anticipated event for investors, as it provides insight into the central bank’s decision on the monetary tightening path. In the current climate, the meeting is even more critical, as investors are holding their breath as they await the storm that may be on the horizon.

The Fed’s decision on the monetary tightening path will have a significant impact on U.S. stocks. If the Fed decides to take a more hawkish stance, it could lead to higher interest rates, which could cause a sell-off in equities. On the other hand, if the Fed decides to take a more dovish stance, it could provide a boost to U.S. stocks.

During the two-day policy meeting, the Federal Open Market Committee (FOMC) discusses the state of the U.S. economy and decides on the appropriate monetary policy. The FOMC is made up of the seven members of the Board of Governors and five of the twelve Federal Reserve Bank presidents.

At the end of the meeting, Fed Chair Jerome Powell holds a press conference to announce the central bank’s decision on the monetary tightening path. Investors closely watch Powell’s conference to gauge the central bank’s sentiment and adjust their investment strategies accordingly.

The Federal Reserve’s decision on the monetary tightening path is not just important for U.S. investors, but also for investors around the world. The U.S. dollar is the world’s reserve currency, and changes in U.S. interest rates can have a significant impact on global financial markets.

In conclusion, the Federal Reserve’s two-day policy meeting is a critical event for investors, as it provides insight into the central bank’s decision on the monetary tightening path. The Fed’s decision will have a significant impact on U.S. stocks and global financial markets. Investors are holding their breath as they await the storm that may be on the horizon, and the Fed’s decision will provide guidance on how to navigate the uncertain times ahead.

Tesla’s Gains Cap Losses

Tesla Inc. (TSLA) has been a bright spot in the midst of muted U.S. stocks, as its sales of China-made electric vehicles have risen 1.7% in early trade. This has provided a glimmer of hope for investors who are waiting for key inflation data that could have a significant impact on U.S. stocks.

Tesla has been a market leader in the electric vehicle industry, with its innovative technology and high-quality products attracting a loyal customer base. The company’s stock has been on a rollercoaster ride in recent years, with significant gains and losses.

Despite the recent market volatility, Tesla’s long-term prospects remain strong. The company has a robust pipeline of new products, including the highly anticipated Cybertruck and the Tesla Semi. Tesla’s battery technology is also seen as a game-changer, with the company investing heavily in research and development to improve its battery technology.

Tesla’s gains in early trade have helped to cap losses in the U.S. stock market, providing a glimmer of hope for investors who are waiting for key inflation data. Tesla’s success is a testament to the company’s innovative technology, strong brand, and loyal customer base.

Tesla’s gains have provided a glimmer of hope in the midst of the waiting game for key inflation data. The company’s innovative technology and strong brand have helped it to weather the storm of market volatility, and its long-term prospects remain strong. Tesla’s success is a bright spot in the U.S. stock market, and investors will be watching closely to see how the company performs in the coming months.

Conclusion

As investors await key inflation data, U.S. stocks have been muted, with the Federal Reserve’s monetary tightening path hanging in the balance. Signs of sticky U.S. inflation, shockwaves from the collapse of two regional U.S. banks, and trouble in some European banks have caused a repricing of interest rate expectations from the Fed. Investors are holding their breath as they await the storm that may be on the horizon, and Tesla’s gains have provided a glimmer of hope in the midst of the waiting game.